Do You Pay Sales Tax On Services In Washington State . To pay your sales tax liability, go to the dor website, complete your sales tax return, and remit. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Web the state general sales tax rate of washington is 6.5%. New sales tax regulations are being implemented frequently on services as. Web paying sales tax in washington. Web retail services are services subject to sales tax. Cities and/or municipalities of washington are allowed to collect their own rate that can get up to 3.9% in city. Web just like products, not all services are subject to sales tax. Below is a listing of service categories that are subject to sales tax when. Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states.

from blog.usgeocoder.com

Web retail services are services subject to sales tax. Web the state general sales tax rate of washington is 6.5%. Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states. Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Below is a listing of service categories that are subject to sales tax when. To pay your sales tax liability, go to the dor website, complete your sales tax return, and remit. Web paying sales tax in washington. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web just like products, not all services are subject to sales tax. New sales tax regulations are being implemented frequently on services as.

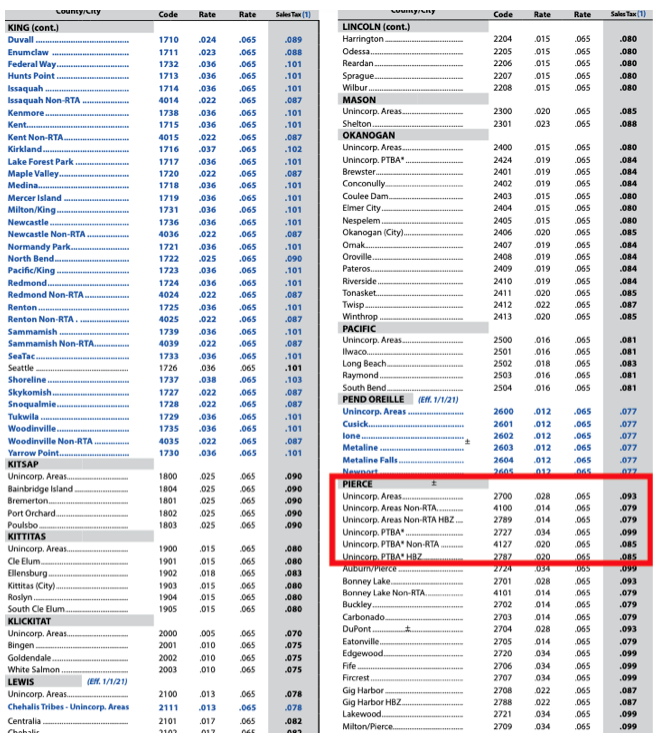

Washington State Sales Tax Rate USgeocoder Blog

Do You Pay Sales Tax On Services In Washington State Cities and/or municipalities of washington are allowed to collect their own rate that can get up to 3.9% in city. Below is a listing of service categories that are subject to sales tax when. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. New sales tax regulations are being implemented frequently on services as. Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Web the state general sales tax rate of washington is 6.5%. Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states. Web paying sales tax in washington. Cities and/or municipalities of washington are allowed to collect their own rate that can get up to 3.9% in city. To pay your sales tax liability, go to the dor website, complete your sales tax return, and remit. Web retail services are services subject to sales tax. Web just like products, not all services are subject to sales tax.

From prorfety.blogspot.com

Are Property Taxes High In Washington State PRORFETY Do You Pay Sales Tax On Services In Washington State Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Web just like products, not all services are subject to sales tax. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Cities and/or municipalities of washington are allowed. Do You Pay Sales Tax On Services In Washington State.

From minemoto.weebly.com

minemoto Blog Do You Pay Sales Tax On Services In Washington State Web just like products, not all services are subject to sales tax. Web paying sales tax in washington. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states. Web retail services. Do You Pay Sales Tax On Services In Washington State.

From digital.library.unt.edu

[Texas sales tax exemption certificate from the Texas Human Rights Do You Pay Sales Tax On Services In Washington State New sales tax regulations are being implemented frequently on services as. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Web the state general sales tax rate of. Do You Pay Sales Tax On Services In Washington State.

From www.facebook.com

James Scott Tax Service Washington NJ Do You Pay Sales Tax On Services In Washington State Web the state general sales tax rate of washington is 6.5%. Web paying sales tax in washington. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states. Below is a listing. Do You Pay Sales Tax On Services In Washington State.

From opportunitywa.org

Tax Foundation "U.S. Businesses Pay or Remit 93 Percent of All Taxes Do You Pay Sales Tax On Services In Washington State Below is a listing of service categories that are subject to sales tax when. New sales tax regulations are being implemented frequently on services as. Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states. Web here’s what merchants need to know about which services are taxable in the state of washington,. Do You Pay Sales Tax On Services In Washington State.

From ridesurfboard.com

Why do we pay sales Tax? ridesurfboard Do You Pay Sales Tax On Services In Washington State Web retail services are services subject to sales tax. To pay your sales tax liability, go to the dor website, complete your sales tax return, and remit. Below is a listing of service categories that are subject to sales tax when. Cities and/or municipalities of washington are allowed to collect their own rate that can get up to 3.9% in. Do You Pay Sales Tax On Services In Washington State.

From taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation Do You Pay Sales Tax On Services In Washington State Web retail services are services subject to sales tax. Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web the state general sales tax rate of washington is 6.5%. Web. Do You Pay Sales Tax On Services In Washington State.

From willabellaomady.pages.dev

Minimum Wage 2024 Wa State Tax Kiele Merissa Do You Pay Sales Tax On Services In Washington State Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. New sales tax regulations are being implemented frequently on services as. Web the state general sales tax rate of washington is 6.5%. Web just like products, not all services are subject to sales tax. To pay your sales tax. Do You Pay Sales Tax On Services In Washington State.

From doralinwjaime.pages.dev

Washington State Sales Tax 2024 Calculator Calla Hyacintha Do You Pay Sales Tax On Services In Washington State Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states. New sales tax regulations are being implemented frequently on services as. Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Web the state general sales tax rate of washington is 6.5%.. Do You Pay Sales Tax On Services In Washington State.

From payroll.wsu.edu

hrpaychhrpaycheck Payroll Services Washington State University Do You Pay Sales Tax On Services In Washington State Cities and/or municipalities of washington are allowed to collect their own rate that can get up to 3.9% in city. Web paying sales tax in washington. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web businesses must pay retail sales tax on purchases for their own use. Do You Pay Sales Tax On Services In Washington State.

From gauday.com

Top 23 do i need to collect sales tax in every state in 2022 Gấu Đây Do You Pay Sales Tax On Services In Washington State Below is a listing of service categories that are subject to sales tax when. Web paying sales tax in washington. Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Web the state general sales tax rate of washington is 6.5%. Web while washington's sales tax generally applies to most. Do You Pay Sales Tax On Services In Washington State.

From www.njpp.org

Undocumented Immigrants Pay Taxes County Breakdown of Taxes Paid New Do You Pay Sales Tax On Services In Washington State New sales tax regulations are being implemented frequently on services as. Web paying sales tax in washington. Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Below is a listing of service categories that are subject to sales tax when. Web here’s what merchants need to know about which. Do You Pay Sales Tax On Services In Washington State.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Do You Pay Sales Tax On Services In Washington State Web paying sales tax in washington. Web the state general sales tax rate of washington is 6.5%. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web while washington's sales tax generally applies to most transactions, certain items have special treatment in many states. Cities and/or municipalities of. Do You Pay Sales Tax On Services In Washington State.

From www.formsbank.com

Use Tax Return State Of Washington Department Of Revenue printable Do You Pay Sales Tax On Services In Washington State Below is a listing of service categories that are subject to sales tax when. Web paying sales tax in washington. New sales tax regulations are being implemented frequently on services as. To pay your sales tax liability, go to the dor website, complete your sales tax return, and remit. Web here’s what merchants need to know about which services are. Do You Pay Sales Tax On Services In Washington State.

From www.signnow.com

Missouri Sales Tax Form 53 1 Instruction Fill Out and Sign Printable Do You Pay Sales Tax On Services In Washington State Web here’s what merchants need to know about which services are taxable in the state of washington, which has a state. Web the state general sales tax rate of washington is 6.5%. Web retail services are services subject to sales tax. Cities and/or municipalities of washington are allowed to collect their own rate that can get up to 3.9% in. Do You Pay Sales Tax On Services In Washington State.

From peisnerjohnson.com

Washington State Sales Tax Sales Tax in Spokane Washington Peisner Do You Pay Sales Tax On Services In Washington State To pay your sales tax liability, go to the dor website, complete your sales tax return, and remit. Web the state general sales tax rate of washington is 6.5%. New sales tax regulations are being implemented frequently on services as. Web here’s what merchants need to know about which services are taxable in the state of washington, which has a. Do You Pay Sales Tax On Services In Washington State.

From zamp.com

Ultimate Washington Sales Tax Guide Zamp Do You Pay Sales Tax On Services In Washington State Below is a listing of service categories that are subject to sales tax when. Web retail services are services subject to sales tax. Web paying sales tax in washington. To pay your sales tax liability, go to the dor website, complete your sales tax return, and remit. Cities and/or municipalities of washington are allowed to collect their own rate that. Do You Pay Sales Tax On Services In Washington State.

From blog.usgeocoder.com

Washington State Sales Tax Rate USgeocoder Blog Do You Pay Sales Tax On Services In Washington State Web the state general sales tax rate of washington is 6.5%. Web retail services are services subject to sales tax. Web just like products, not all services are subject to sales tax. Web businesses must pay retail sales tax on purchases for their own use (such as supplies, equipment, or retail services). Web here’s what merchants need to know about. Do You Pay Sales Tax On Services In Washington State.